The Role Of Insurance Brokers In Finding Coverage

The Role of Insurance Brokers in Finding Coverage

As we navigate through life, we often find ourselves seeking protection from the unknown. Whether it’s our health, home, business, or loved ones, insurance plays a vital role in providing us with financial security and peace of mind. However, with the numerous insurance options available, finding the right coverage can be a daunting task. This is where insurance brokers come in – experts who guide us through the complex world of insurance and help us make informed decisions.

In this article, we’ll delve into the role of insurance brokers, their benefits, and how they can assist you in finding the perfect coverage for your needs.

Who are Insurance Brokers?

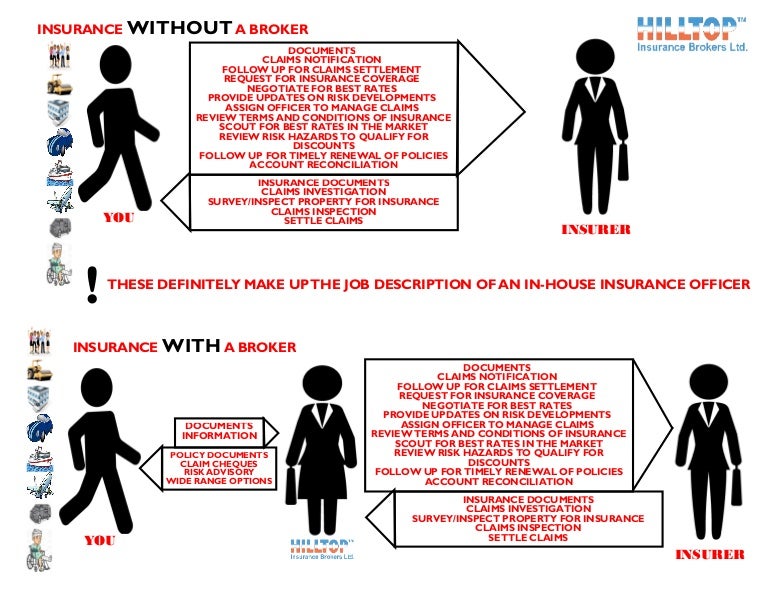

Insurance brokers, also known as independent agents or producers, act as intermediaries between clients and insurance companies. They’re licensed professionals with extensive knowledge of insurance products and market trends. Brokers represent multiple insurance companies, allowing them to offer a wide range of policies and options.

Unlike insurance company agents, who work exclusively for one insurer, brokers operate independently. This independence enables them to provide unbiased recommendations and advise clients on the most suitable policies for their specific situation.

The Benefits of Working with an Insurance Broker

So, why should you consider working with an insurance broker? Here are just a few benefits of partnering with these experts:

- Impartial Advice: Brokers work for you, not the insurance company. They’ll provide you with unbiased recommendations, ensuring you receive the best possible coverage for your needs.

- Access to Multiple Insurance Companies: Brokers represent multiple insurers, giving you a wider range of options and increasing the likelihood of finding the perfect policy.

- Time-Saving: Brokers handle the legwork, researching and comparing policies on your behalf. This saves you time and effort, allowing you to focus on more pressing matters.

- Personalized Service: Brokers take the time to understand your unique needs and goals, tailoring their advice and recommendations accordingly.

- Claims Support: In the event of a claim, brokers will often assist with the process, ensuring you receive fair and timely compensation.

How Insurance Brokers Can Help You Find Coverage

Insurance brokers follow a structured approach when helping clients find coverage. Here’s a step-by-step guide on how they typically work:

- Initial Consultation: The broker will schedule a meeting with you to discuss your insurance needs and goals. This is an opportunity to share your concerns, ask questions, and outline your expectations.

- Risk Assessment: The broker will assess your risk exposure and identify areas that require coverage. This may involve analyzing your lifestyle, business, or other relevant factors.

- Policy Research: The broker will research and compare policies from multiple insurance companies. They’ll evaluate the coverage options, terms, and conditions of each policy to determine the best fit for your needs.

- Policy Recommendations: Based on their research, the broker will recommend a selection of policies that meet your requirements. They’ll explain the benefits, limitations, and costs of each policy, ensuring you understand the terms.

- Policy Implementation: Once you’ve selected a policy, the broker will assist with the application process, ensuring all necessary documentation is completed correctly.

- Ongoing Support: The broker will continue to support you throughout the policy’s duration, addressing any questions or concerns that may arise.

Types of Insurance Brokers

While insurance brokers can specialize in various areas, here are some of the most common types:

- Life and Health Insurance Brokers: These brokers focus on individual and group life insurance, health insurance, and disability insurance.

- Property and Casualty Insurance Brokers: These brokers specialize in homeowners insurance, auto insurance, liability insurance, and other types of property and casualty insurance.

- Commercial Insurance Brokers: These brokers work with businesses, providing insurance solutions for liability, property, workers’ compensation, and other commercial needs.

- Employee Benefits Brokers: These brokers assist with group benefits, such as health insurance, dental insurance, and retirement plans.

How to Find the Right Insurance Broker

Finding the right insurance broker requires some research and due diligence. Here are some tips to help you get started:

- Ask for Referrals: Ask friends, family, or colleagues for recommendations. They may have worked with a broker in the past and can provide valuable insights.

- Check Licenses and Certifications: Ensure the broker is licensed and certified to operate in your state or province. You can check with your local insurance department or regulatory body for verification.

- Check Industry Affiliations: Look for brokers who belong to industry associations, such as the National Association of Insurance and Financial Advisors (NAIFA) or the Independent Insurance Agents & Brokers of America (IIABA).

- Read Reviews and Testimonials: Research the broker’s reputation online, reading reviews and testimonials from past clients.

- Meet with the Broker: Schedule a meeting with the broker to discuss your needs and goals. This will give you an opportunity to assess their expertise and communication style.

Conclusion

Insurance brokers play a vital role in helping individuals and businesses find the right coverage for their needs. By working with a broker, you can access impartial advice, a wide range of insurance options, and personalized service. When selecting a broker, be sure to research their licenses, certifications, and industry affiliations. With the right broker by your side, you can navigate the complex world of insurance with confidence.

Frequently Asked Questions

What’s the difference between an insurance broker and an insurance agent?

Insurance brokers represent multiple insurance companies, while agents work exclusively for one insurer.How do insurance brokers get paid?

Brokers typically earn a commission on the policies they sell. However, some brokers may charge a fee for their services.Can I purchase insurance directly from the insurance company?

Yes, you can purchase insurance directly from the insurance company. However, this may limit your options and access to impartial advice.Do insurance brokers offer ongoing support?

Yes, many insurance brokers provide ongoing support, addressing any questions or concerns that may arise throughout the policy’s duration.Can I switch insurance brokers if I’m not satisfied with my current broker?

Yes, you can switch insurance brokers if you’re not satisfied with your current broker. Be sure to research and evaluate potential new brokers before making a decision.

Comments

Post a Comment