Understanding Coverage Limits And Exclusions: A Guide To Making Informed Choices

Understanding Coverage Limits and Exclusions: A Guide to Making Informed Choices

When it comes to insurance, understanding coverage limits and exclusions is crucial to making informed choices that protect you, your loved ones, and your assets. Whether you’re buying health insurance, home insurance, auto insurance, or any other type of insurance, knowing what’s covered and what’s not can be the difference between financial security and disaster.

In this article, we’ll break down the basics of coverage limits and exclusions, provide examples of common exclusions, and offer tips on how to navigate the fine print to make the most of your insurance policies.

What are Coverage Limits?

Coverage limits refer to the maximum amount of money your insurance policy will pay out in the event of a claim. Think of it as a cap on the benefits you’ll receive if something goes wrong. For example, if you have a health insurance policy with a coverage limit of $100,000 per year, your insurance company will pay up to that amount for medical expenses, but no more.

Coverage limits can vary widely depending on the type of insurance, the insurer, and the policy terms. Some policies may have a single coverage limit that applies to all benefits, while others may have separate limits for different types of losses or claims.

Types of Coverage Limits

There are different types of coverage limits to be aware of:

- Aggregate limit: This is the maximum amount of money your insurance company will pay out in a single year, regardless of the number of claims you make.

- Per-occurrence limit: This is the maximum amount of money your insurance company will pay out for a single event or claim.

- Deductible: This is the amount of money you must pay out of pocket before your insurance coverage kicks in.

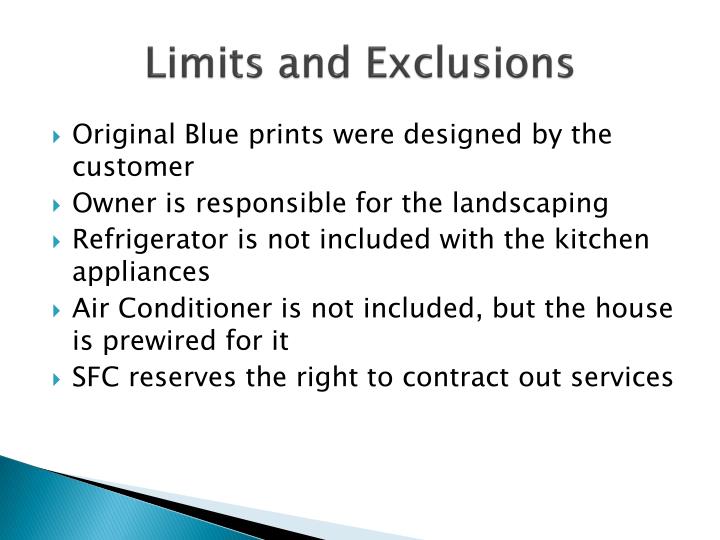

What are Exclusions?

Exclusions are specific situations or events that are not covered by your insurance policy. Think of them as loopholes that can leave you exposed to financial loss if you’re not careful. Exclusions can be found in various types of insurance policies, including health, home, and auto insurance.

Common Exclusions

Here are some common exclusions to look out for:

- Pre-existing medical conditions: Many health insurance policies exclude coverage for pre-existing medical conditions, such as diabetes or heart disease.

- High-risk activities: Some insurance policies, such as travel insurance or life insurance, may exclude coverage for high-risk activities, such as skydiving or rock climbing.

- Natural disasters: Home insurance policies may exclude coverage for natural disasters, such as earthquakes or floods.

- Acts of terrorism: Many insurance policies, including travel insurance and health insurance, exclude coverage for acts of terrorism.

- Poor maintenance: Home insurance policies may exclude coverage for damage caused by poor maintenance, such as a burst pipe due to lack of maintenance.

Other Factors to Consider

In addition to coverage limits and exclusions, there are other factors to consider when choosing an insurance policy:

- Deductible: The deductible is the amount of money you must pay out of pocket before your insurance coverage kicks in.

- Coinsurance: Coinsurance is the percentage of medical expenses you must pay after meeting your deductible.

- Waiting period: Some insurance policies, such as health insurance or life insurance, may have a waiting period before benefits are paid out.

- Riders: Riders are add-ons to your insurance policy that can provide additional coverage or benefits.

Tips for Navigating Coverage Limits and Exclusions

Here are some tips to help you navigate coverage limits and exclusions:

- Read the fine print: Take the time to read your insurance policy documents carefully, and ask questions if you’re unsure about coverage limits or exclusions.

- Compare policies: Compare different insurance policies to find the one that best meets your needs and budget.

- Understand the exclusions: Make sure you understand the exclusions in your insurance policy and plan accordingly.

- Consider additional coverage options: Consider purchasing additional coverage options, such as umbrella insurance or riders, to supplement your existing coverage.

Real-Life Examples

Here are some real-life examples of how coverage limits and exclusions can impact your financial security:

Example 1: Health Insurance

Sarah, a 30-year-old marketing executive, has a health insurance policy with a coverage limit of $100,000 per year. She’s involved in a car accident and suffers serious injuries that require multiple surgeries and hospital stays. Her medical expenses exceed $200,000, but her insurance policy only pays out the coverage limit of $100,000. She’s left with a medical bill of $100,000, which she must pay out of pocket.

Example 2: Home Insurance

David, a 40-year-old homeowner, has a home insurance policy that excludes coverage for natural disasters. A hurricane hits his neighborhood, damaging his home and belongings. He’s left with a repair bill of $50,000, which he must pay out of pocket because his insurance policy excludes coverage for natural disasters.

Conclusion

Understanding coverage limits and exclusions is crucial to making informed choices about your insurance policies. By taking the time to read the fine print, compare policies, and understand the exclusions, you can ensure that you’re protected from financial loss in the event of an unexpected event. Remember to also consider additional coverage options, such as umbrella insurance or riders, to supplement your existing coverage.

Final Tips

- Don’t assume: Don’t assume that your insurance policy covers everything.

- Ask questions: Ask questions if you’re unsure about coverage limits or exclusions.

- Review and update: Review and update your insurance policies regularly to ensure they still meet your needs and budget.

By following these tips and staying informed, you can make the most of your insurance policies and enjoy financial peace of mind.

Comments

Post a Comment