The Importance Of Identity Theft Protection Insurance: Safeguarding Your Digital Footprint

The Importance of Identity Theft Protection Insurance: Safeguarding Your Digital Footprint

In today’s digital age, our personal information is more vulnerable than ever. With the rise of online transactions, social media, and data breaches, identity theft has become a growing concern. Identity theft protection insurance is a crucial tool in safeguarding your digital footprint and protecting your financial well-being. In this article, we will delve into the importance of identity theft protection insurance and how it can help you prevent and recover from identity theft.

What is Identity Theft?

Identity theft occurs when an individual or group steals your personal information, such as your name, social security number, credit card numbers, or passport information, to commit fraud or other crimes. This can lead to financial loss, damage to your credit score, and even emotional distress. According to the Federal Trade Commission (FTC), identity theft affects millions of Americans each year, with the average victim losing around $1,200.

Types of Identity Theft

There are several types of identity theft, including:

- Financial Identity Theft: This type of identity theft involves stealing your financial information, such as credit card numbers or bank account numbers, to make unauthorized transactions.

- Social Security Number Identity Theft: This type of identity theft involves stealing your social security number to commit employment-related identity theft or to access your benefits.

- Medical Identity Theft: This type of identity theft involves stealing your medical information, such as your insurance information or medical records, to receive medical care or benefits.

- Child Identity Theft: This type of identity theft involves stealing a child’s identity, often to commit financial crimes or to access benefits.

The Importance of Identity Theft Protection Insurance

Identity theft protection insurance is designed to help you prevent and recover from identity theft. This type of insurance typically includes a range of services, such as:

- Monitoring Services: This includes 24/7 monitoring of your credit reports, social media accounts, and other online activity to detect potential threats.

- Alerts and Notifications: You will receive alerts and notifications if suspicious activity is detected, allowing you to take action quickly.

- Identity Theft Resolution: If your identity is stolen, your insurance provider will work with you to resolve the issue and restore your identity.

- Reimbursement and Compensation: Depending on the policy, you may be reimbursed for out-of-pocket expenses related to identity theft, such as the cost of replacing credit cards or other documents.

Benefits of Identity Theft Protection Insurance

The benefits of identity theft protection insurance are numerous:

- Peace of Mind: With identity theft protection insurance, you can rest assured that your personal information is being monitored and protected.

- Early Detection: Your insurance provider can detect potential identity theft quickly, allowing you to take action before the situation escalates.

- Expert Resolution: If your identity is stolen, your insurance provider will work with you to resolve the issue and restore your identity.

- Financial Protection: Depending on the policy, you may be reimbursed for out-of-pocket expenses related to identity theft.

Choosing the Right Identity Theft Protection Insurance

With so many identity theft protection insurance providers available, choosing the right one can be overwhelming. Here are some tips to consider:

- Research: Research different insurance providers and compare their services, pricing, and reviews.

- Coverage: Consider the level of coverage you need and choose a policy that aligns with your needs.

- Reputation: Look for an insurance provider with a good reputation and a proven track record of helping victims of identity theft.

- Customer Service: Choose an insurance provider with excellent customer service, including 24/7 support.

Ways to Prevent Identity Theft

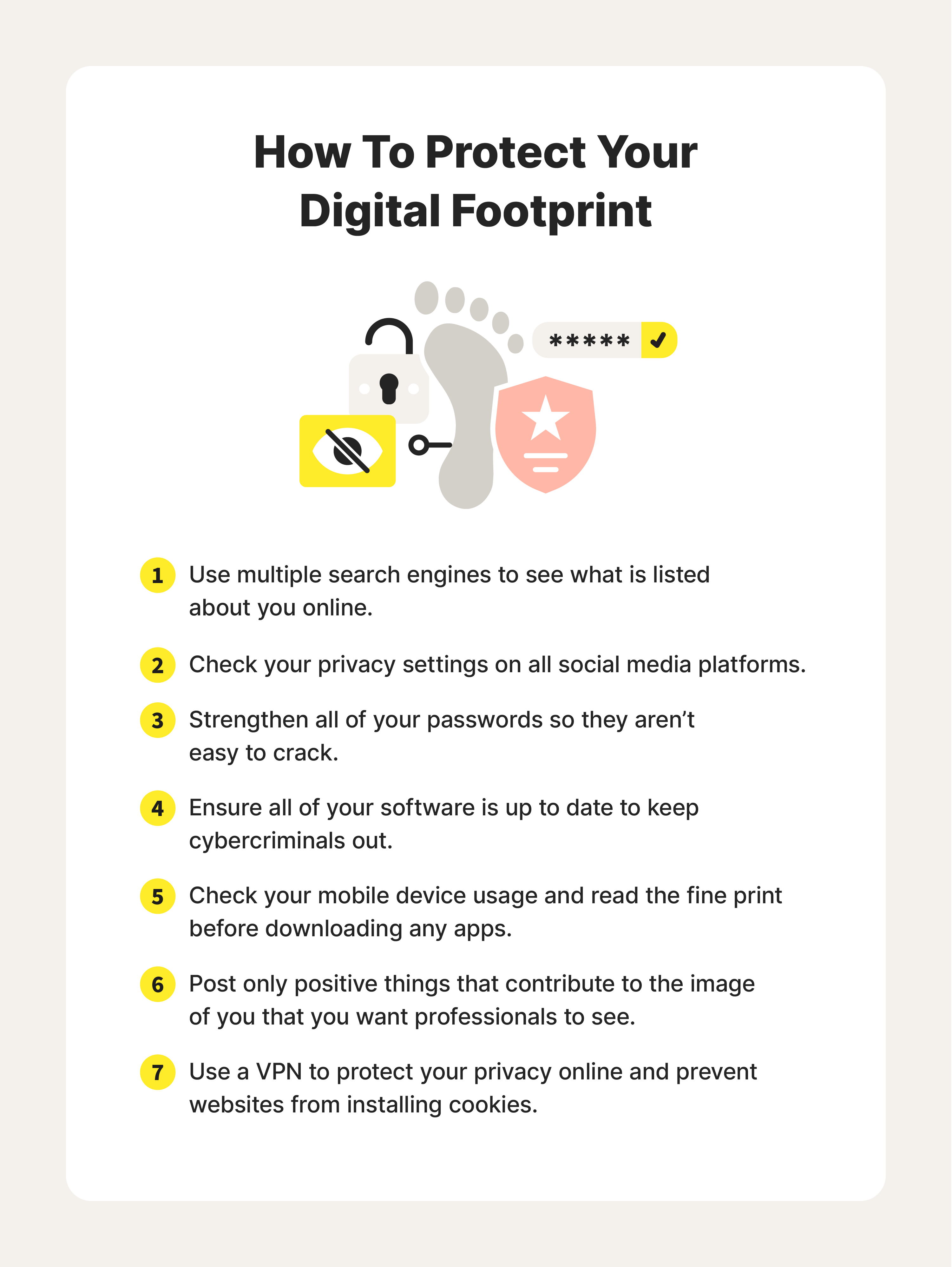

In addition to investing in identity theft protection insurance, there are several ways to prevent identity theft:

- Use Strong Passwords: Use strong, unique passwords for all of your online accounts.

- Monitor Your Credit Reports: Check your credit reports regularly to detect potential threats.

- Be Cautious of Phishing Scams: Be wary of emails or phone calls that ask for personal information.

- Use Two-Factor Authentication: Use two-factor authentication whenever possible to add an extra layer of security to your online accounts.

- Shred Sensitive Documents: Shred sensitive documents, such as bank statements or credit card offers, to prevent identity thieves from accessing your information.

Conclusion

Identity theft protection insurance is a crucial tool in safeguarding your digital footprint and protecting your financial well-being. With the right insurance provider and a few simple precautions, you can help prevent identity theft and ensure your peace of mind. Remember to research different insurance providers, consider the level of coverage you need, and look for an insurance provider with a good reputation and excellent customer service.

Additional Tips

- Consider Additional Services: Consider additional services, such as credit report monitoring or identity theft resolution, when choosing an insurance provider.

- Read Reviews: Read reviews from other customers to get a sense of the insurance provider’s effectiveness.

- Ask Questions: Ask questions when researching an insurance provider to ensure you understand their services and policies.

- Keep Your Software Up-to-Date: Keep your software and operating system up-to-date to prevent vulnerabilities that can be exploited by identity thieves.

- Stay Vigilant: Stay vigilant when online and be cautious of suspicious activity to prevent identity theft.

Frequently Asked Questions

- Q: What is identity theft protection insurance?

A: Identity theft protection insurance is a type of insurance designed to help you prevent and recover from identity theft. - Q: How does identity theft protection insurance work?

A: Identity theft protection insurance typically includes a range of services, such as monitoring, alerts, identity theft resolution, and reimbursement and compensation. - Q: Do I really need identity theft protection insurance?

A: Yes, identity theft protection insurance is an important investment in protecting your digital footprint and financial well-being. - Q: What are the benefits of identity theft protection insurance?

A: The benefits of identity theft protection insurance include peace of mind, early detection, expert resolution, and financial protection. - Q: How do I choose the right identity theft protection insurance provider?

A: Consider researching different insurance providers, choosing a policy that aligns with your needs, looking for an insurance provider with a good reputation, and considering additional services.

By following these tips and choosing the right identity theft protection insurance provider, you can help safeguard your digital footprint and protect your financial well-being.

Comments

Post a Comment