The Pros And Cons Of Group Insurance Plans: Understanding What's Best For You And Your Loved Ones

The Pros and Cons of Group Insurance Plans: Understanding What’s Best for You and Your Loved Ones

As an individual, navigating the complex world of insurance can be overwhelming, especially when it comes to deciding on the right plan for you and your loved ones. One popular option is group insurance plans, which allow multiple individuals to pool their resources and secure coverage under a single policy. In this article, we’ll delve into the pros and cons of group insurance plans, exploring what’s best for you and your family.

What are Group Insurance Plans?

Before we dive into the pros and cons, let’s define what group insurance plans are. Group insurance plans are policies that cover a group of people, typically employees or members of an organization, under a single contract. These plans are usually offered by employers, trade unions, or professional associations, and are designed to provide comprehensive coverage to all members.

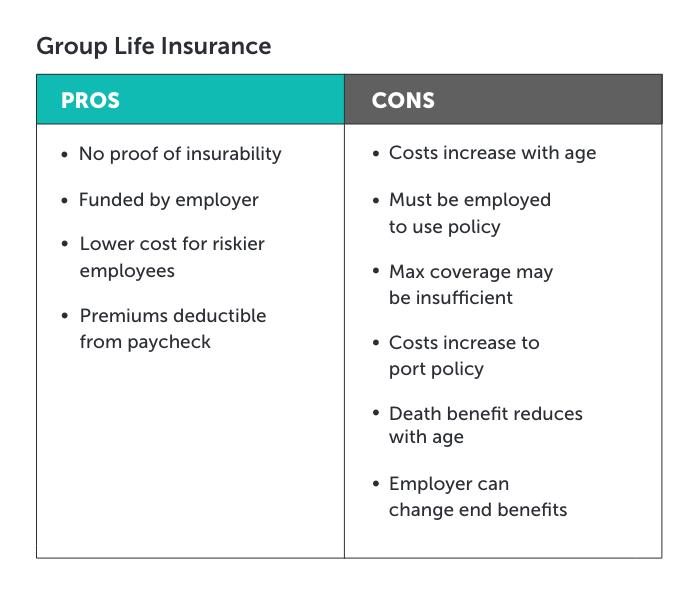

Pros of Group Insurance Plans

Now that we have a clear understanding of what group insurance plans are, let’s explore the benefits of these plans. Here are some of the key pros:

Cost-Effective: Group insurance plans are often less expensive than individual policies, as the risk is spread across multiple individuals. This makes it more affordable for employers and employees to secure coverage.

Comprehensive Coverage: Group insurance plans often offer more comprehensive coverage than individual policies, including additional benefits such as dental and vision care.

Network of Providers: Group insurance plans typically have a larger network of providers, making it easier to find a doctor or medical facility that accepts the insurance.

Tax Benefits: Employers can deduct premiums paid on group insurance plans as a business expense, reducing their tax liability.

Convenience: Group insurance plans are often easier to manage, as employers handle the administrative tasks, such as premium payments and policy changes.

No Medical Underwriting: In many cases, group insurance plans do not require medical underwriting, making it easier for individuals with pre-existing conditions to secure coverage.

Employer Contributions: Many employers contribute to the premium cost, reducing the financial burden on employees.

Cons of Group Insurance Plans

While group insurance plans offer many benefits, there are also some drawbacks to consider. Here are some of the key cons:

Limited Flexibility: Group insurance plans may not offer the same level of flexibility as individual policies, as the coverage is standardized for all members.

Dependence on Employer: Group insurance plans are often tied to employment, which means that if you change jobs or become unemployed, you may lose coverage.

Limited Personalization: Group insurance plans are designed to meet the needs of the majority, rather than individual needs.

Premium Increases: Premiums for group insurance plans can increase significantly over time, as the risk pool changes.

Provider Limitations: While group insurance plans have a larger network of providers, some plans may still have limitations on which providers are covered.

Added Administrative Tasks: Employers may have to handle additional administrative tasks, such as deducting premiums from paychecks and managing policy changes.

Risk Pooling: Group insurance plans rely on the concept of risk pooling, which means that healthy individuals are subsidizing those who are less healthy.

Who is Best Suited for Group Insurance Plans?

Group insurance plans are often well-suited for:

Employers: Group insurance plans can be a valuable employee benefit, helping to attract and retain top talent.

Employees: Employees who are unable to secure individual coverage due to pre-existing conditions may find group insurance plans a viable option.

Small Business Owners: Group insurance plans can be a cost-effective way for small business owners to provide coverage to their employees.

Trade Unions: Group insurance plans can be a valuable benefit for trade union members.

What Alternatives to Group Insurance Plans Are Available?

While group insurance plans can be a great option for many individuals, they may not be the best choice for everyone. Here are some alternatives:

Individual Insurance Policies: Individual policies offer more flexibility and personalization, but may be more expensive.

Private Insurance Exchanges: Private insurance exchanges allow individuals to shop for insurance plans and compare rates.

Health Savings Accounts (HSAs): HSAs allow individuals to save pre-tax dollars for medical expenses.

Self-Insured Plans: Self-insured plans involve employers paying directly for medical expenses, rather than purchasing a group insurance policy.

Conclusion

Group insurance plans can be a valuable option for individuals and employers, offering comprehensive coverage and tax benefits. However, it’s essential to consider the pros and cons, weighing the benefits against the limitations. By understanding the advantages and disadvantages of group insurance plans, you can make an informed decision about what’s best for you and your loved ones.

Final Tips

Carefully Review the Plan: Read the fine print and understand what’s covered and what’s not.

Compare Rates: Shop around and compare rates from different providers.

Assess Your Needs: Consider your health needs and whether the plan meets your requirements.

Consider Alternatives: Explore alternative options, such as individual policies or private insurance exchanges.

By following these tips and considering your options carefully, you can find the right insurance plan for you and your loved ones.

Sources

- Insurance Information Institute. (2022). Group Health Insurance.

- National Association of Insurance Commissioners. (2022). Group Insurance.

- Kaiser Family Foundation. (2022). Employer-Sponsored Family Health Premiums Rise 4% in 2022.

- Internal Revenue Service. (2022). IRS Health Savings Accounts.

This article provides a comprehensive overview of the pros and cons of group insurance plans, exploring what’s best for you and your loved ones. By understanding the benefits and limitations of group insurance plans, you can make an informed decision about what’s right for you.

Comments

Post a Comment