How To File A Health Insurance Claim: A Step-by-Step Guide

How to File a Health Insurance Claim: A Step-by-Step Guide

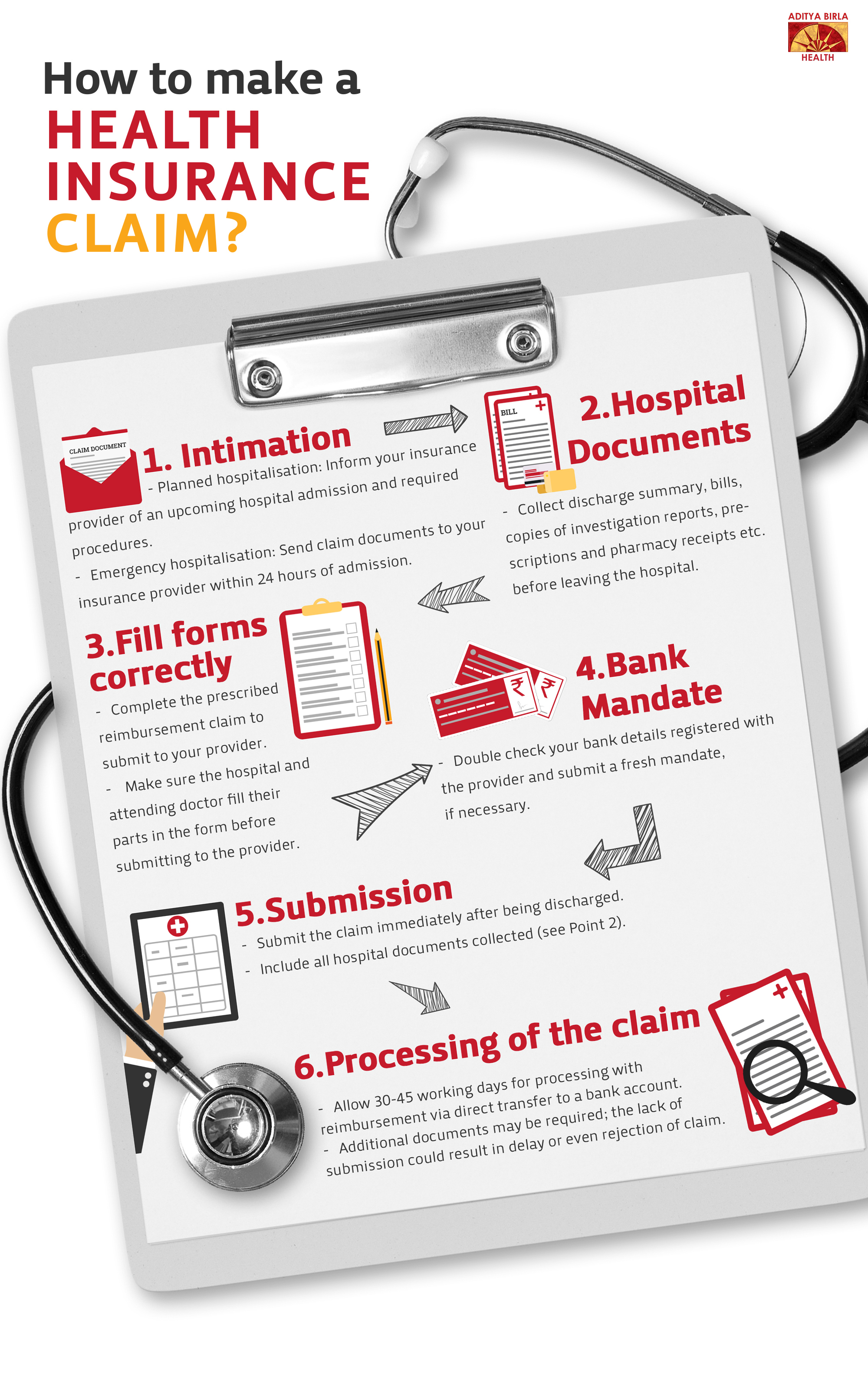

Are you or a loved one dealing with a medical condition or injury? If so, navigating the healthcare system can be overwhelming, especially when it comes to filing a health insurance claim. The good news is that filing a health insurance claim doesn’t have to be a daunting task. In this article, we’ll walk you through the process, explaining each step in a clear and concise manner. By the end of this guide, you’ll be equipped with the knowledge and confidence to file your claim and get the coverage you need.

Understanding Your Health Insurance Policy

Before we dive into the claim process, it’s essential to understand your health insurance policy. Take a few minutes to review your policy documents, paying attention to the following:

- Policy coverage: What services and treatments are covered under your plan?

- Deductible: How much do you need to pay out-of-pocket before your insurance kicks in?

- Copays and coinsurance: What amounts do you need to pay for each doctor visit, prescription, or treatment?

- Network: Are you required to see in-network providers, or can you visit any doctor or hospital?

- Claims process: How do you submit a claim, and what documentation is required?

Step 1: Review Your Medical Bills

Once you’ve received medical treatment, you’ll receive a bill or statements from your healthcare provider. Review these documents carefully, making sure you understand what you’re being charged for. Check for any errors, such as:

- Incorrect dates or services: Verify that the dates and services listed on the bill match your medical records.

- Incorrect charges: Ensure that the charges listed on the bill are accurate and align with your policy coverage.

Step 2: Gather Required Documents

To file a health insurance claim, you’ll need to collect the necessary documents. These may include:

- Medical records: Obtain copies of your medical records, including test results, diagnoses, and treatment plans.

- Itemized bills: Request itemized bills from your healthcare provider, breaking down charges into specific services or treatments.

- Prescription records: Collect records of any prescriptions filled, including dosage and dates taken.

- Proof of payment: Provide proof of any payments made, including receipts or cancelled checks.

Step 3: Complete the Claim Form

Most health insurance companies provide a claim form that you need to complete and submit with your supporting documents. This form will ask for:

- Personal information: Your name, date of birth, and policy number.

- Medical information: A description of your medical condition, treatment, and outcomes.

- Billing information: The provider’s name, address, and charges for services rendered.

Step 4: Submit Your Claim

Once you’ve completed the claim form and gathered all required documents, it’s time to submit your claim. You can typically do this:

- Online: Many health insurance companies have online portals where you can upload your claim form and supporting documents.

- Mail: Mail your claim form and documents to the insurance company’s claims address.

- Phone: Some insurance companies allow you to submit claims over the phone, with the option to fax or email supporting documents.

Step 5: Follow Up on Your Claim

After submitting your claim, it’s essential to follow up with your insurance company to ensure it’s being processed correctly. You can:

- Check your online account: Log in to your insurance company’s online portal to view the status of your claim.

- Call the claims department: Contact the claims department to ask about the status of your claim and any additional documentation required.

- Request a claims update: Ask for a written update on the status of your claim, including any approved or denied services.

Common Claim Issues and How to Resolve Them

While filing a health insurance claim can be straightforward, issues can arise. Here are some common problems and how to resolve them:

- Denied claim: If your claim is denied, review your policy coverage and ensure that the services or treatments were included. You can also appeal the decision by submitting additional documentation or speaking with a claims representative.

- Delayed claim: If your claim is taking longer than expected to process, contact the claims department to ask about the status and any additional documentation required.

- Billing errors: If you notice billing errors, such as incorrect charges or services listed, contact your healthcare provider and insurance company to resolve the issue.

Tips for a Smooth Claims Process

Filing a health insurance claim can be a lengthy process, but there are ways to make it smoother:

- Keep detailed records: Keep accurate records of your medical treatment, including dates, services, and charges.

- Communicate with your provider: Inform your healthcare provider about your insurance coverage and any specific requirements or restrictions.

- Stay organized: Keep all supporting documents and claim forms in a designated folder or file, making it easier to access them when needed.

- Ask questions: Don’t hesitate to ask your insurance company or healthcare provider about any aspect of the claims process.

Conclusion

Filing a health insurance claim doesn’t have to be overwhelming. By understanding your policy, reviewing your medical bills, gathering required documents, and completing the claim form, you’ll be well on your way to getting the coverage you need. Remember to follow up on your claim, address any issues that arise, and take advantage of tips for a smooth claims process. With patience and persistence, you’ll navigate the claims process with confidence and get the medical care you deserve.

Additional Resources

If you need further assistance with filing a health insurance claim, consider the following resources:

- National Association of Insurance Commissioners (NAIC): A non-profit organization that provides information and resources on health insurance and claims processes.

- Centers for Medicare and Medicaid Services (CMS): A government agency that provides information on Medicare and Medicaid coverage and claims processes.

- Your insurance company’s website: Many insurance companies have online resources, FAQs, and claims portals to help you navigate the claims process.

Glossary of Terms

- Deductible: The amount you need to pay out-of-pocket before your insurance coverage kicks in.

- Copay: A fixed amount you pay for each doctor visit or prescription.

- Coinsurance: A percentage of the medical bill you need to pay after meeting your deductible.

- Network: A group of healthcare providers who have a contractual agreement with your insurance company to provide discounted services.

- Claim form: A document that you need to complete and submit with supporting documents to file a health insurance claim.

Comments

Post a Comment