How To Appeal An Insurance Claim Denial: A Step-by-Step Guide

How to Appeal an Insurance Claim Denial: A Step-by-Step Guide

Receiving an insurance claim denial can be a stressful and overwhelming experience, especially if you’re counting on the insurance company to cover a significant expense. However, a denial doesn’t necessarily mean the end of the road. You have the right to appeal the decision, and with the right guidance, you can increase your chances of having the denial overturned.

In this article, we’ll walk you through the process of appealing an insurance claim denial, from understanding the reasons behind the denial to presenting your case to the insurance company. We’ll also provide you with valuable tips and strategies to help you navigate the appeals process with confidence.

Understanding the Reasons Behind the Denial

Before you start the appeals process, it’s essential to understand why your claim was denied in the first place. The insurance company should have provided you with a written explanation of the denial, including the specific reasons for the decision.

Common reasons for insurance claim denials include:

- Lack of coverage: The insurance company may have determined that the service or treatment you received is not covered under your policy.

- Pre-existing condition: The insurance company may have decided that your condition existed before you purchased the policy, and therefore, it’s not covered.

- Insufficient documentation: The insurance company may have requested additional documentation to support your claim, but you failed to provide it.

- Medical necessity: The insurance company may have determined that the service or treatment you received was not medically necessary.

Step 1: Review Your Policy

Before you start the appeals process, it’s crucial to review your insurance policy to understand what is covered and what is not. Check your policy to see if it includes a clause that allows you to appeal a denied claim.

Step 2: Gather Supporting Documentation

To appeal a denied claim, you’ll need to gather supporting documentation to present to the insurance company. This may include:

- Medical records: Collect all relevant medical records, including test results, doctor’s notes, and hospital records.

- Bills and receipts: Gather all bills and receipts related to the denied claim.

- Letters from healthcare providers: Ask your healthcare providers to write letters explaining the medical necessity of the service or treatment you received.

- Additional information: If the insurance company requested additional information to support your claim, make sure to provide it.

Step 3: Write a Clear and Concise Appeal Letter

Your appeal letter should be clear, concise, and well-organized. Here are some tips to keep in mind:

- Use a formal tone: Avoid using emotional language or personal attacks.

- State your case: Clearly explain why you believe the insurance company made a mistake in denying your claim.

- Provide evidence: Include all supporting documentation to back up your claim.

- Specify what you’re asking for: Clearly state what you’re asking the insurance company to do, such as covering the denied service or treatment.

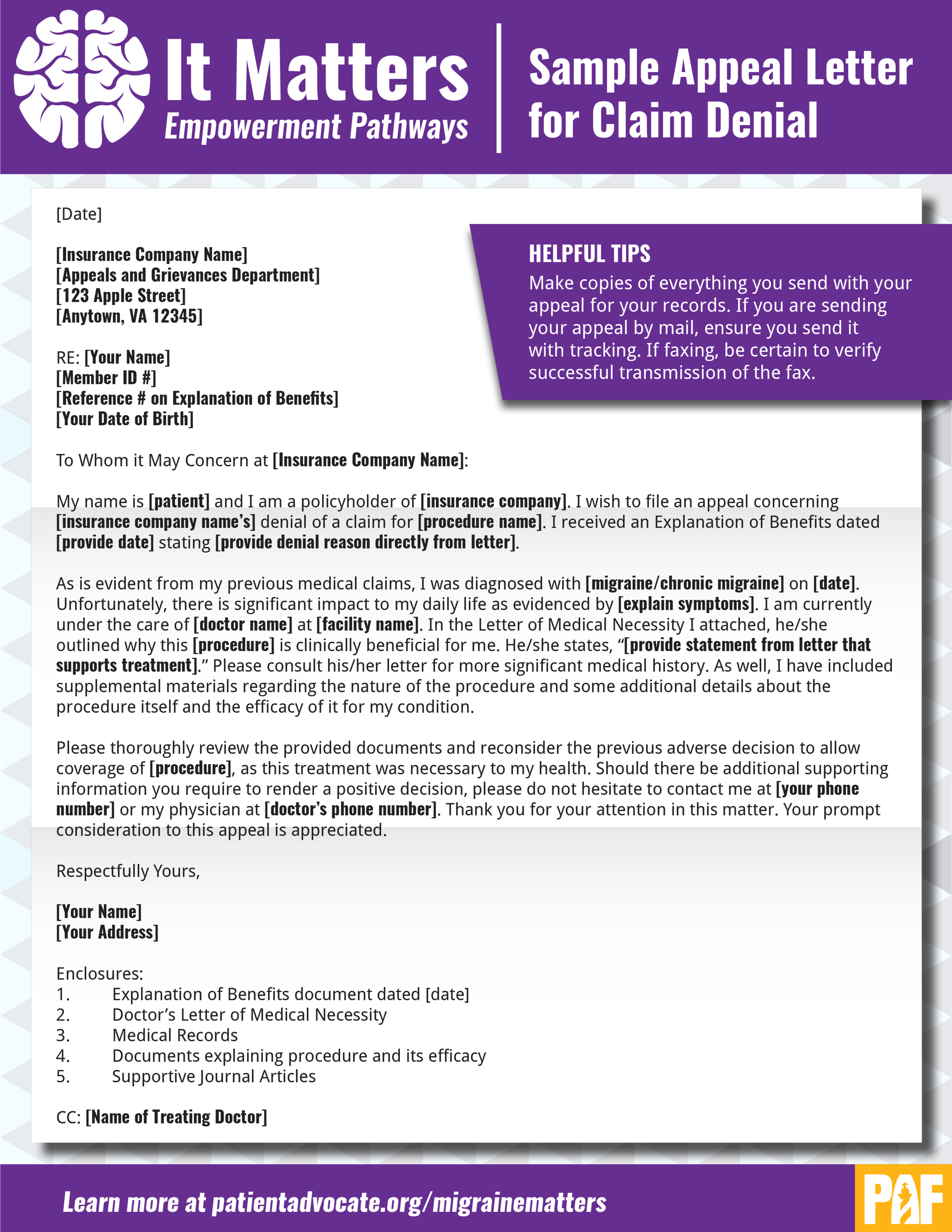

Here’s an example of an appeal letter:

[Your Name]

[Your Address]

[City, State, Zip]

[Email Address]

[Phone Number]

[Date]

[Insurance Company]

[Insurance Company Address]

[City, State, Zip]

Re: Denied Claim for [Service or Treatment]

Dear [Insurance Company Representative],

I am writing to appeal the denial of my claim for [service or treatment]. I received a letter from your company stating that my claim was denied due to [reason for denial].

I strongly disagree with this decision and believe that my policy covers the service or treatment I received. I have attached supporting documentation, including medical records and bills, to demonstrate the medical necessity of the service or treatment.

I respectfully request that you reconsider my claim and cover the denied service or treatment. Please review the attached documentation and let me know if you require any additional information.

Thank you for your attention to this matter. I look forward to hearing from you soon.

Sincerely,

[Your Name]

Step 4: Submit Your Appeal

Once you’ve written your appeal letter and gathered all supporting documentation, it’s time to submit your appeal to the insurance company. Make sure to follow the insurance company’s guidelines for submitting an appeal, which may include:

- Emailing or mailing your appeal letter and supporting documentation to the insurance company.

- Faxing your appeal letter and supporting documentation to the insurance company.

- Submitting your appeal online through the insurance company’s website.

Step 5: Wait for a Response

After submitting your appeal, wait for a response from the insurance company. This may take several weeks or even months, depending on the complexity of your case and the insurance company’s workload.

If your appeal is successful, the insurance company will reverse the denial and cover the service or treatment you received. If your appeal is unsuccessful, you may need to consider further action, such as filing a complaint with your state’s department of insurance or seeking the help of a patient advocate.

Additional Tips and Strategies

Here are some additional tips and strategies to help you navigate the appeals process:

- Keep detailed records: Keep a record of all correspondence with the insurance company, including dates, times, and details of conversations.

- Be persistent: Don’t give up if your appeal is initially denied. Continue to appeal until you’ve exhausted all options.

- Seek help: Consider seeking the help of a patient advocate or a healthcare attorney if you’re unsure about the appeals process or need additional guidance.

- Stay calm and patient: The appeals process can be long and frustrating, but it’s essential to stay calm and patient throughout the process.

Conclusion

Receiving an insurance claim denial can be a stressful and overwhelming experience, but it’s not the end of the road. By understanding the reasons behind the denial, gathering supporting documentation, and writing a clear and concise appeal letter, you can increase your chances of having the denial overturned.

Remember to stay calm and patient throughout the appeals process, and don’t hesitate to seek help if you need additional guidance or support. With the right approach and mindset, you can navigate the appeals process with confidence and achieve a successful outcome.

Frequently Asked Questions

Q: How long does the appeals process typically take?

A: The appeals process can take anywhere from a few weeks to several months, depending on the complexity of your case and the insurance company’s workload.

Q: What happens if my appeal is successful?

A: If your appeal is successful, the insurance company will reverse the denial and cover the service or treatment you received.

Q: Can I appeal a denied claim if I’m not satisfied with the amount the insurance company paid?

A: Yes, you can appeal a denied claim if you’re not satisfied with the amount the insurance company paid. This is known as a "partial denial" claim.

Q: Can I hire a healthcare attorney to help me with the appeals process?

A: Yes, you can hire a healthcare attorney to help you with the appeals process. A healthcare attorney can provide guidance and support throughout the process and help you navigate the complex appeals process.

Q: What if I’m not happy with the insurance company’s response to my appeal?

A: If you’re not happy with the insurance company’s response to your appeal, you may need to consider further action, such as filing a complaint with your state’s department of insurance or seeking the help of a patient advocate.

Comments

Post a Comment